EDI 810

Invoice

What is EDI 810?

An EDI 810 Invoice is sent by a seller to a buyer, to indicate the charges due, and request payment according to agreed-upon terms. This EDI transaction can be used instead of sending a paper, email, or PDF invoice. While other EDI invoicing documents such as EDI 210, EDI 880 and EDI 894 invoices are each used for a specific type of transaction, an EDI 810 Invoice can be used across a range of order types.

EDI 810 documents follow the x12 format set by the American National Standards Institute (ANSI), a not-for-profit organization that regulates EDI formats in the U.S.

What are the Essential Components of EDI 810?

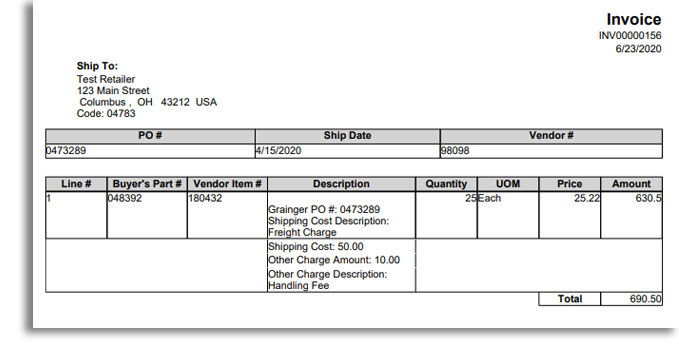

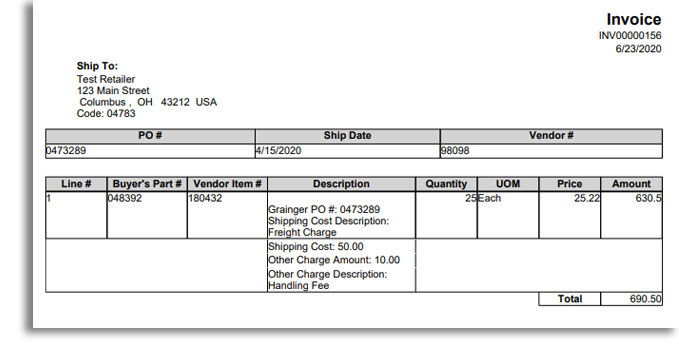

Just like a paper invoice, the EDI 810 Invoice transaction set needs to include several pieces of information about each order. These may include (but are not limited to):

- Invoice number and date

- Buyer, Seller, and Remittance identification details

- Order details, including product quantities and prices

- Additional charges, discounts, and/or allowances

- Total amount due

- Acceptable payment methods

- Payment terms

- Tax detail where applicable

How Do I Use EDI 810?

EDI 810 is normally sent by a seller, such as a manufacturer or distributor, to a buyer such as a retailer, after an order is shipped. The document confirms that the order has been delivered, and requests payment from the buyer to close out the order.

After receiving an EDI 810 document, buyers will confirm receipt with an EDI 997 Functional Acknowledgement. Upon confirming that the details on the invoice are correct, the invoice should be transferred to the buyer’s accounting/receivables department to issue payment. At this point, the buyer can also respond with an EDI 820 Payment Order or Remittance Advice Document, which communicates payment details back to the seller.

What are the Benefits of EDI 810?

As an EDI document, EDI 810 Invoices offer better security than paper, fax or emailed documents, thanks to protections like FTPs and HTTPs protocols, and user authentication for EDI portal use. This helps protect both buyer and seller details throughout trading partner transactions.

Using EDI 810 can speed the payments process along, enabling fast reconciliation, so suppliers can quickly recognize revenue from an order. Additionally, automating this transaction helps eliminate errors from manual retyping, which helps to prevent invoice discrepancies that may delay payment.

EDI Format Example

EDI 810 can be viewed in two formats – a human “readable” version and a “raw” data version. The example below shows the raw EDI data, which is usually translated using integrated EDI software, and then sent to your business system (ERP) for use by your EDI manager or other employees.

- Click to See Example

-

ISA*00* *00* *12*9622309900 *ZZ*TESTRETAILER * * *U*00401* *0*T*>

GS*IN*9622309900*TESTGRAINGERLD*20200623*1637**X*004010

ST*810

BIG*20200623*INV00000156**0473289***DR

REF*IA*98098

N1*ST*Test Retailer*92*04783

N3*123 Main Street

N4*Columbus*OH*43212*USA

DTM*011*20200415

IT1*1*25*EA*25.22**CB*048392*VN*180432*PO*0473289

TDS*69050

SAC*C*D240***5000**********Freight Charge

SAC*C*F050***1000**********Handling Fee

CTT*1

SE*13

GE*1

IEA*1*